Configure EU VAT

Changes in EU VAT rules since 1st January 2015.

From 1st January 2015 all supplies of telecommunications, broadcasting and electronic services will be taxable at the place where the customer belongs. In order to ensure the correct taxation of these services, EU and non-EU businesses will need to determine the status of their customer (a taxable or a non-taxable person) and the place (in which country of the EU or outside the EU) where that customer belongs. You can find more info about new rules in this document: http://ec.europa.eu/taxation_customs/resources/documents/taxation/vat/how_vat_works/telecom/explanatory_notes_2015_en.pdf

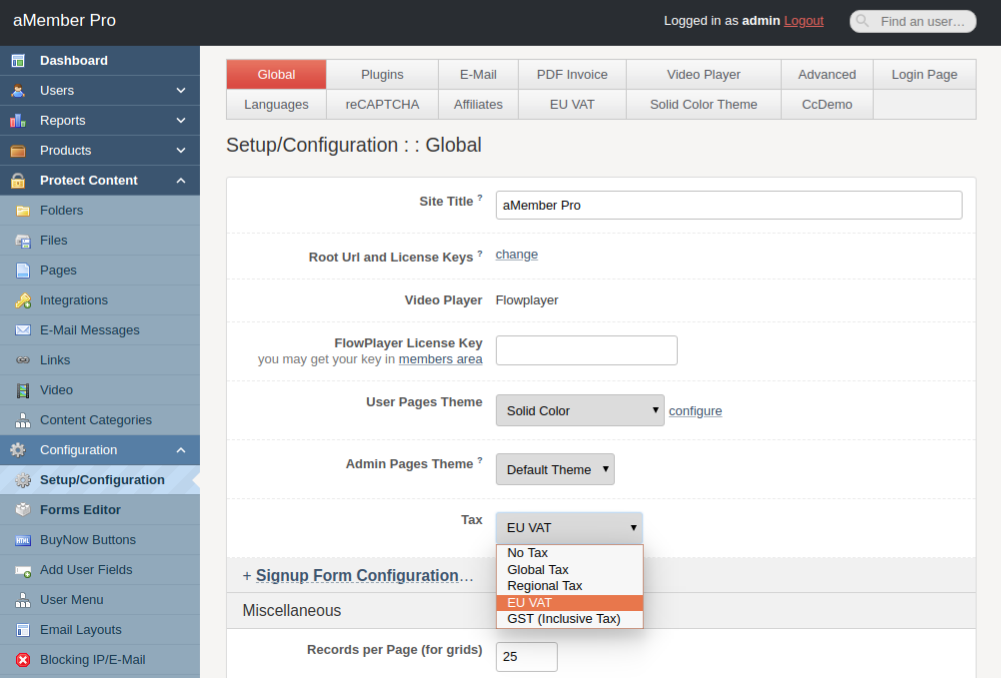

To comply with new rules we have implemented new EU VAT (New Rules 2015) module which can be enabled in aMember CP -> Configuration -> Setup/Configuration -> Global -> Tax

All users who have had old EU Vat plugin enabled must switch to new plugin by 1st January.

EU VAT (New Rules 2015) Configuration

Electronically Supplied Service

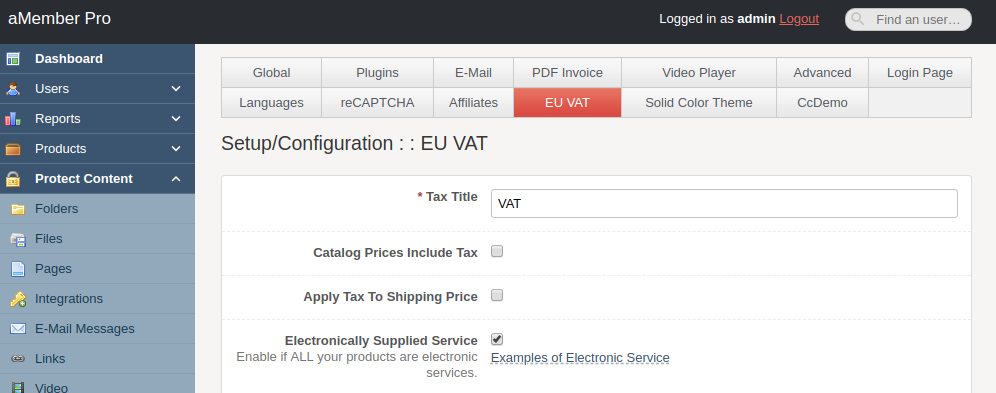

Above changes are for "telecommunications, broadcasting and electronic services" only. So you have to specify your products as "Electronically Supplied Service" in plugin configuration (setting will be applied to all products):

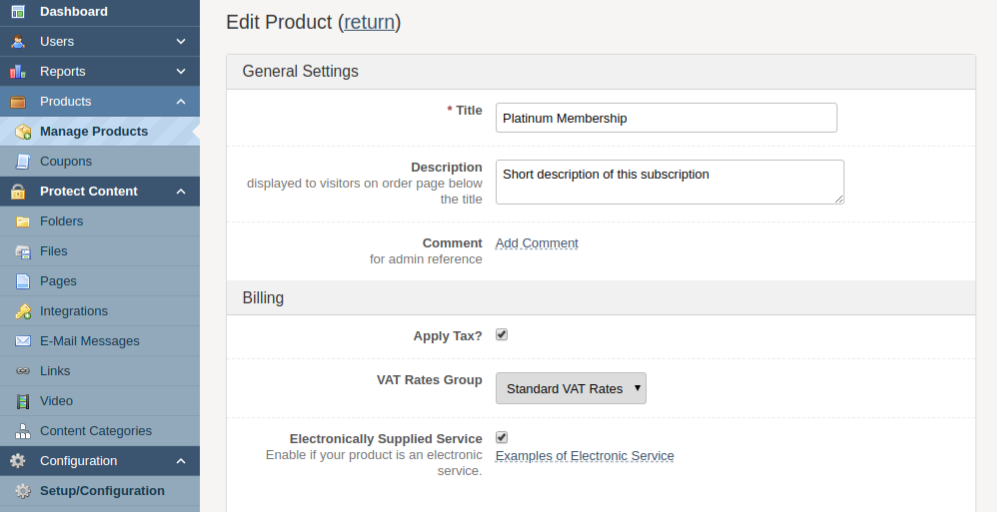

or individually for each product:

Products which are not specified as "Electronically Supplied Service" will be taxed using old rules.

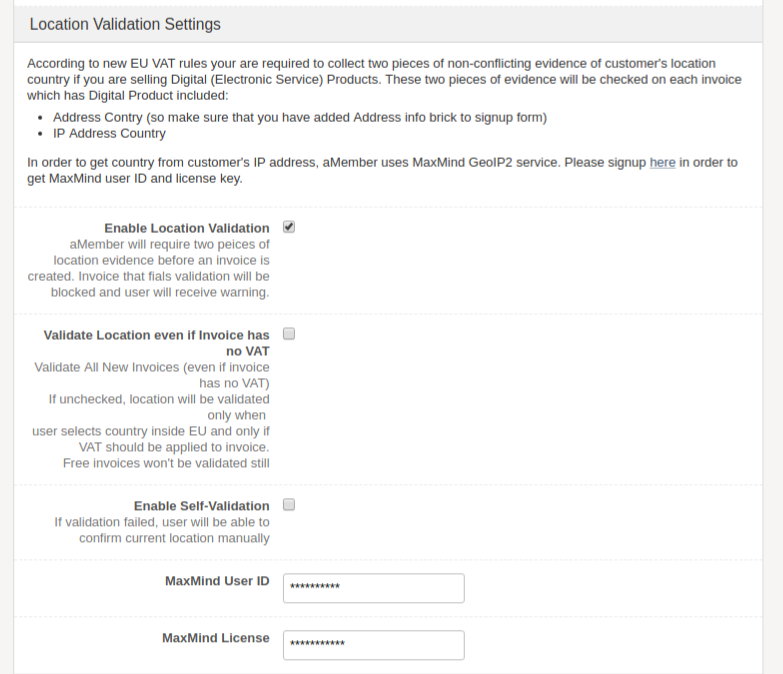

Location Validation

According to new EU VAT Rules you are required to collect two pieces of non-conflicting evidence of customer's location country. This information will be collected for each invoice:

- User's registration country

- User's registration IP-address country

- User's current IP-address country

User registration country will be checked against IP country and registration IP country. That information will be stored in invoice record. Invoice which fails such validation will not be created and user will get an error on signup.

In order to get country by IP address aMember uses MaxMind GeoIP2 service. You can signup for that service here

When Location Validation is disabled, aMember will use country which was specified by user on registration, no additional IP country checks will be processed.

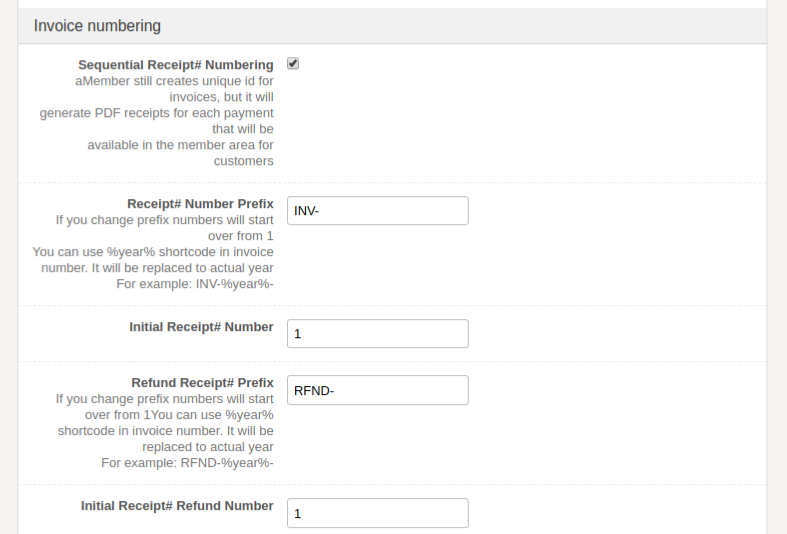

Receipt# numbering

Additionally you can use "Sequential Receipt# Numbering". Each new payment or refund in the system will receive unique sequential receipt ID which will be included in PDF invoices. These receipt numbers will be issued only for completed payments or refunds so there will be no interruptions in numbering. For example first payment will have number: INV-1, second: INV-2 etc...